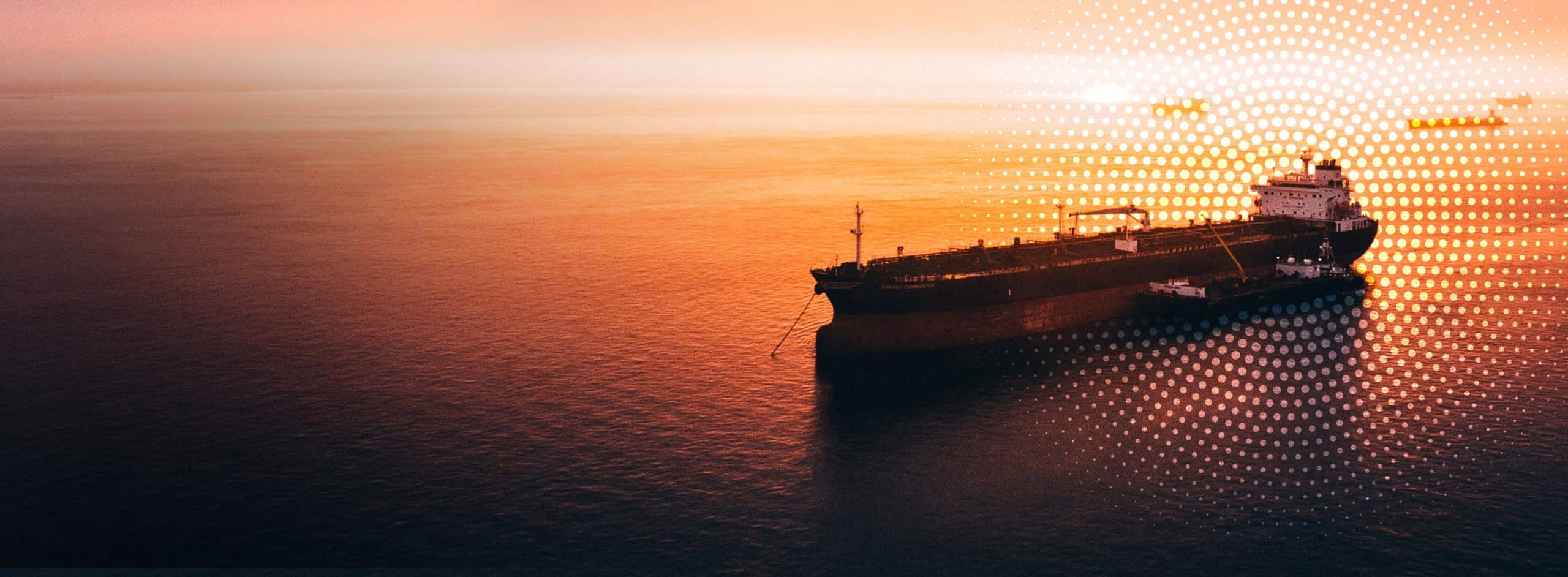

First Time Broadband Delivered in Madagascar

See how we are working against the forces of nature to connect over 100k people and 65 communities in the African island nation.

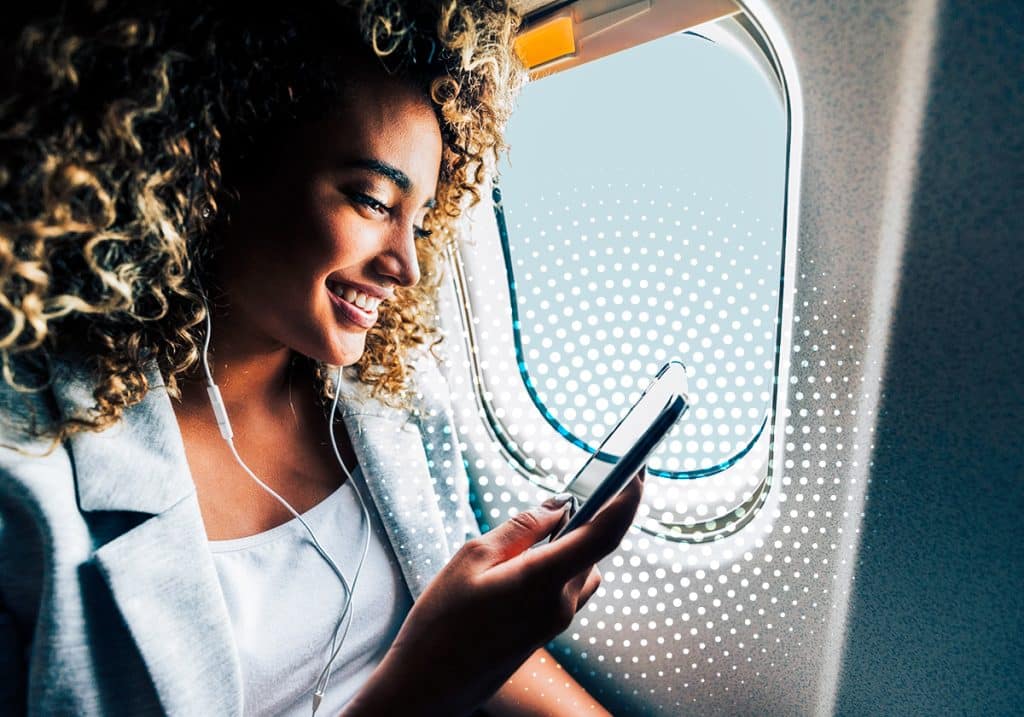

Bringing Reliable Content to All Corners of the World

Learn how Intelsat is helping Sony deliver quality content to over 700 million people in India.